33 months after interest rates began rising, the RBA cut rates for the first time. The cut will provide sweet relief to mortgage holders and businesses but that is all they may get for a while - more sugar hit than a relief of symptoms.

Three point summary

1. RBA cuts the cash rate by 25 bps

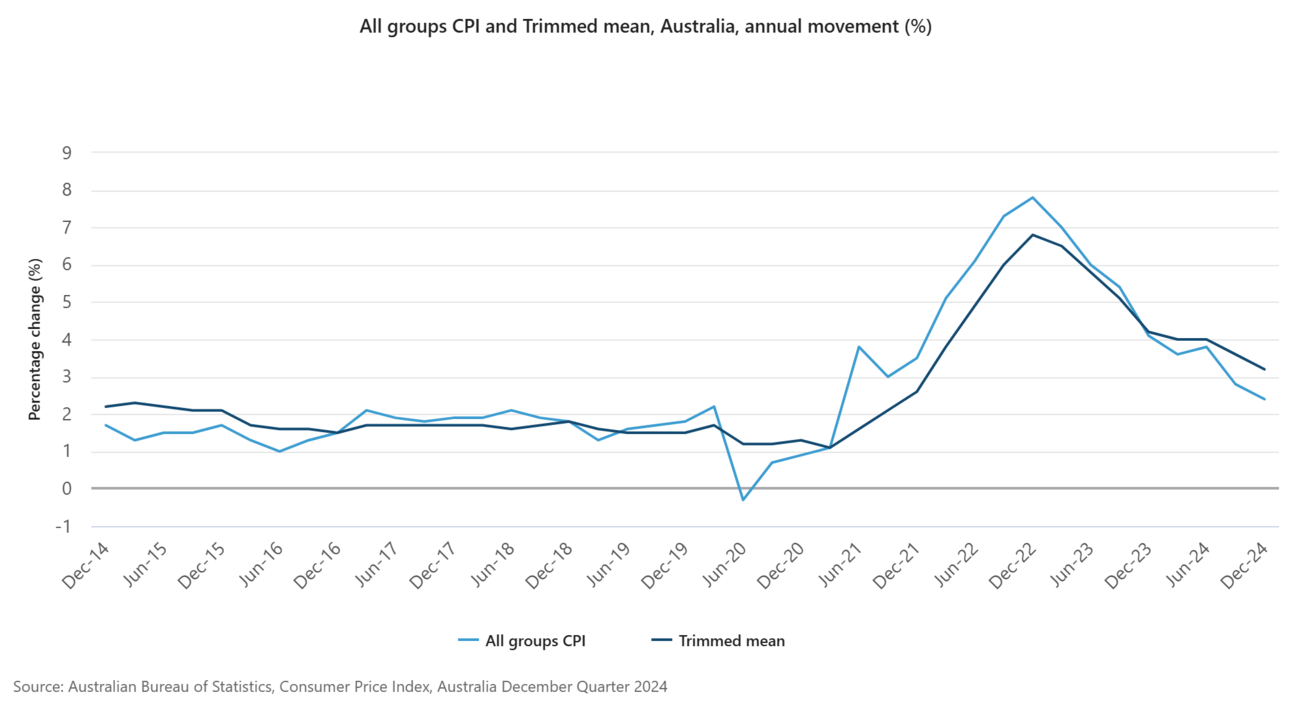

As expected, the RBA cut rates at its first meeting for the year. Back in December, Bullock said the Board had shifted its stance towards easing so when the markets saw that headline and trimmed-mean inflation fell in the December quarter (see chart below), the only way was down.

However, at her press conference, Bullock told markets not to get ahead of themselves by factoring in several more cuts over the course of the year.

The RBA still has strong concerns about inflation and will want to see what happens over the next several months before thinking about cutting again.

I believe that RBA will be inclined to leave rates at their current restrictive setting for the next few meetings unless there is a big surprise in the data on the up or downside.

The Board judges its time to reduce a little of the restrictiveness but we cannot declare victory over inflation just yet.

2. Labour market is tight

One of the RBA’s main concerns is the tightness of the labour market. Like the US, unemployment is at its lowest levels in decades and despite rising interest rates, it has hardly moved. The vacancies-to-unemployment ratio is also rising again and businesses keep telling the RBA that they cannot find enough workers.

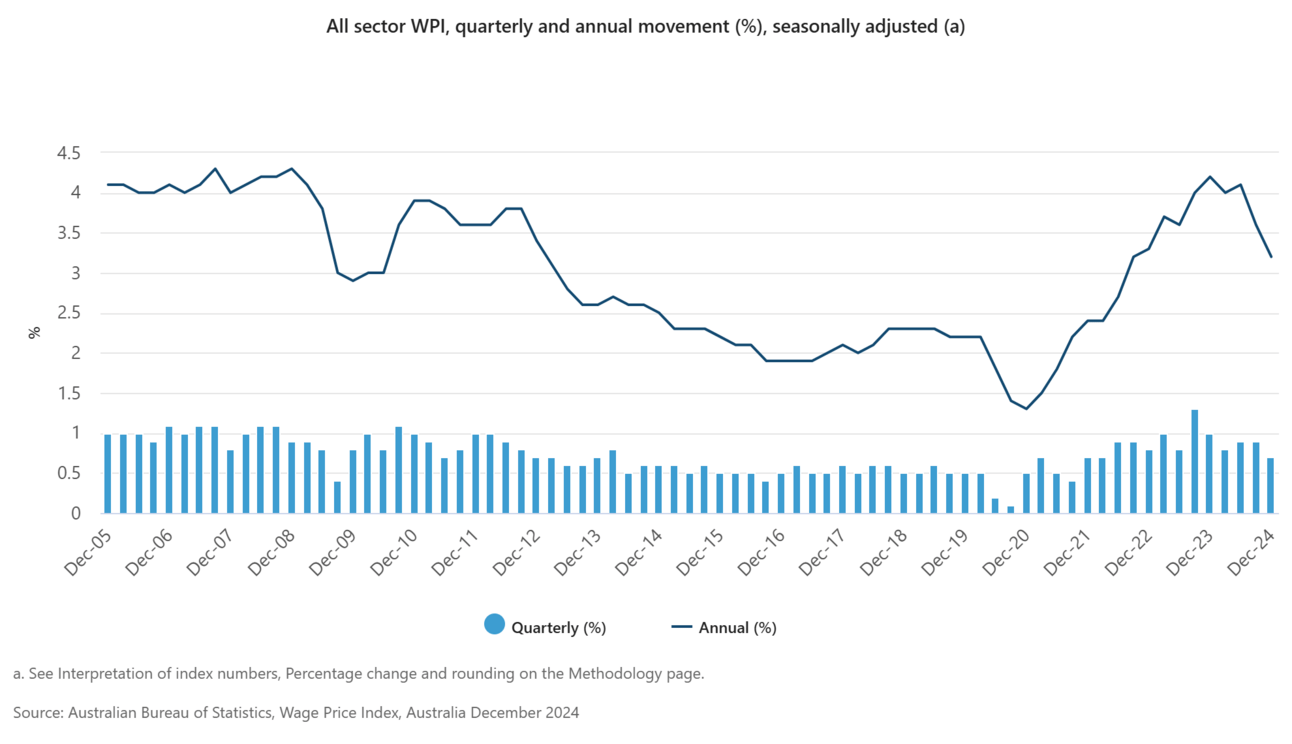

Normally a tight labour market means workers ask for higher wages, particularly if inflation is rising too. However, the Wage-Price Index has been falling since the June quarter of 2024 and the latest result for December continues the downward trend (see chart below).

This leaves the RBA worried. They would like to see some of the steam come out of the labour market because they fear that at some point wages might start going up again.

The main counter argument is that, like in the US, there has been some sort of structural change in the labour market post pandemic, and that we are in a new normal and the RBA shouldn’t be worried. I think it is too early to tell and to risky to say it is “different this time”.

3. The big drug deal

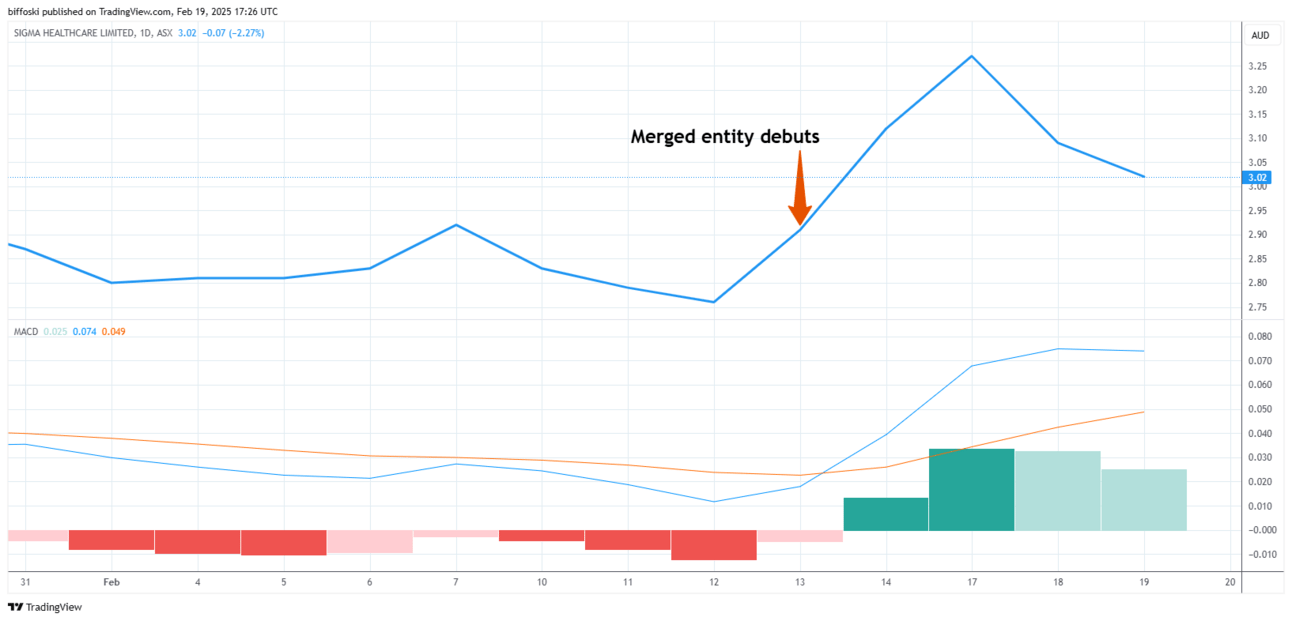

Last Thursday, Chemist Warehouse merged with Sigma Healthcare (SIG) to form a new AUD 34 billion behemoth.

The new entity is now only slightly smaller than Woolworths in terms of market value and owns around 16% of all pharmacies in Australia. Australia’s two-largest grocery retailers, Coles and Woolworths, sell a limited amount of pharmaceutical products but only pharmacies can sell subscription medication.

The stock was up as much as 20% on Monday (17 February) but has since fallen to be up nearly 10% since the merger (see chart below).

Investors have been excited to finally be able to buy shares in the previously unlisted Chemist Warehouse but are also excited by the prospects of the new entity given the synergies between Sigma as a leading distributor of prescription medicine and owner of traditional pharmacies and the leading bulk-discount pharmacy retailer: Chemist Warehouse.

After 50 years of toil, 50 years of grind,

a bit of blood and sweat and tears,

we’ve established ourselves as the leaders of this industry,

Final thoughts

With all the economic uncertainty coming out of the US, it was nice to see some relief for mortgage holders with the cut in interest rates this week. The RBA hasn’t completed its soft landing yet but should be commended on its job so far. While it has taken longer to start cutting rates, it did not raise rates as high as some other central banks who are now desperately cutting rates to help spluttering growth (just look across the ditch to NZ). We can’t win the Bledisloe but our boffins do it better!

Key dates over the next 7 days

February 20: January unemployment rate

February 26: January Monthly CPI