Boom! Core inflation came in hotter than expected for January - don’t expect another US rate cut anytime soon. Needless to say President Trump will be making some angry phone calls to Fed Chair Jerome Powell.

Three point summary

1. Hotter than expected core CPI

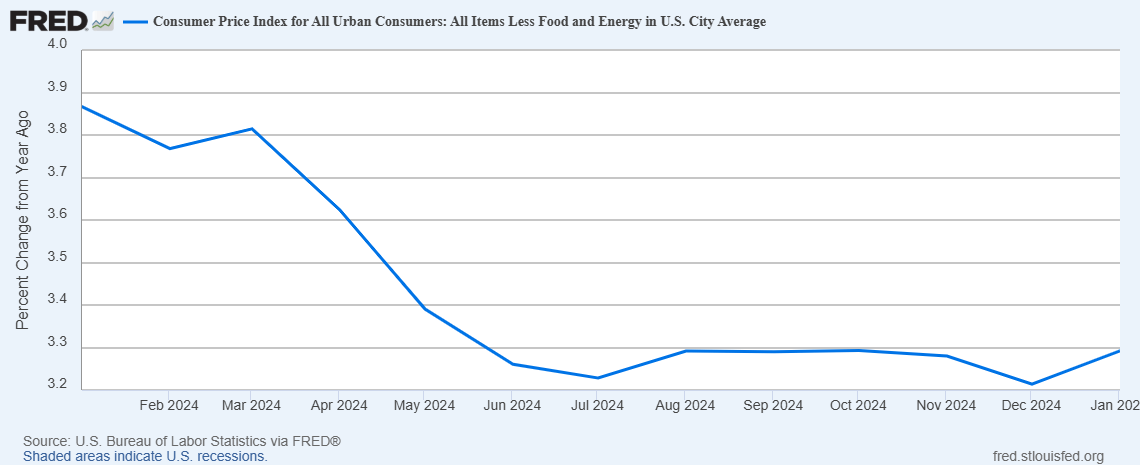

On Wednesday, core CPI (inflation less food and energy) came in at 3.3% on a yearly basis, up from 3.2% in December (see chart below) and higher than the consensus estimate of 3.1%. Transportation services (freight) was the largest upward mover at 8% while shelter remains high at 4.4%.

While only a small increase, the surprise on the upside was another slap in the face for US markets who are dealing with just a little bit of economic uncertainty as Elon Musk cleans the Washington swamp and President Trump raises tariffs on allies and the US’s largest trading partner: China.

Fed Chair Jerome Powell had already put markets on notice by saying that the Fed was going to be more cautious with rate cuts going forward. After the release of the CPI data the probability of a 25 bps rate cut by the May FOMC meeting decreased from 34% to 10% (CME FedWatch).

2. Consumers fearing the worst about inflation

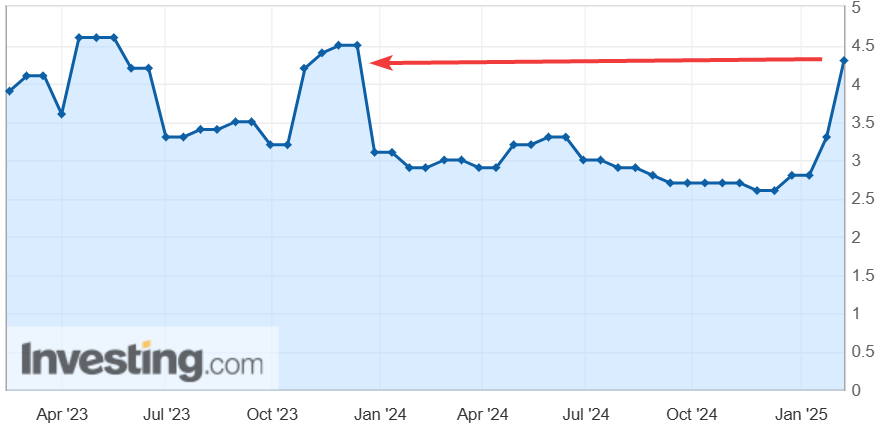

Even before core CPI result was dropped on Wednesday, US consumers were feeling down about inflation. 1-year inflation expectations for February from the University of Michigan (preliminary) showed that US consumers now believe that inflation will be around 4.3% in a year’s time. This is up from 3.3% in January and is the highest level since December 2023 (see chart below).

We all know that believing something is going to be bad can help make it come true (just ask me about my Christmas present) and with inflation this happens when rising consumer inflation expectations push up wage demands and then actual wages.

3. Chinese computers are smarter

Forget your Terminator nightmares of AI taking over the world - Chinese AI is going to take over the world! I better learn Mandarin for “Sarah Connor is on a lunch break”.

A week-and-a-half ago, Chinese AI startup DeepSeek shocked Wall Street with a research paper claiming that they had trained their latest open-source AI model at a fraction of the cost of AI models from US Big Tech. Suddenly, all those orders of NVIDIA GPUs didn’t look so good. On Monday, January 27, Nvidia suffered a nearly USD 600 billion loss in market value - the largest-ever one day loss.

However, Nvidia’s share price is now back up around 14% and the market and Big Tech are now realising that they can also use the efficiencies that Deep Seek pioneered. Everyone wins! AI models are slowing becoming a commodity.

Final thoughts

New US Presidents like to hit the ground running with a string of executive orders. Trump 2.0 is no different but is of course he is bringing his peculiar chaotic style to play. But on the economic front, the administration needs to tread carefully. Higher core CPI and consumer inflation expectations should be a wake up call that the fight against inflation is not yet over. Inflation has been wounded but it still has some life left.

“It will likely be appropriate to hold the funds rate steady for some time.

Key dates over the next 7 days

February 14: retail sales

February 17: President’s Day holiday - markets are closed

February 19: FOMC minutes

February 20: initial jobless claims