CBA’s valuation is sky high! But it seems the only thing that could pop it would be Chinese warships sailing down Sydney Harbour.

Three point summary

1. The CBA bubble

We love those fully-franked bank dividends and nobody does banking in Australia like CBA. While other banks rely ever more on independent mortgage brokers to bring in business, the CBA still brings in much of its mortgage business through its own retail channel.

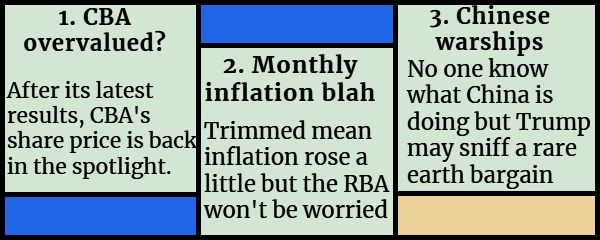

However, analysts see trouble brewing at 11 Harbour Street (see the 12-month share forecasts in the chart below).

CBA seems way overvalued. It has a Price to Earnings (PE) ratio of 27 compared to 14 for ANZ, 16 for NAB, and 17 for WBC. In the US, Bank of America has a PE ratio of 7 and Wells Fargo 14. That means that when investors look at the earnings of CBA compared to ANZ and the Bank of America, they value CBA’s earnings at twice the rate they value ANZ’s earnings and nearly 4x the rate they value Bank of America’s. That does not seem right.

All this talk of a CBA bubble has analysts frothing at the mouth about an upcoming correction but retail investors and super funds are not yet willing to give up on one of their favourites. Maybe it will take a general market correction to knock CBA back down rather than a focused sell off the stock?

2. Inflation data when you don’t have inflation data

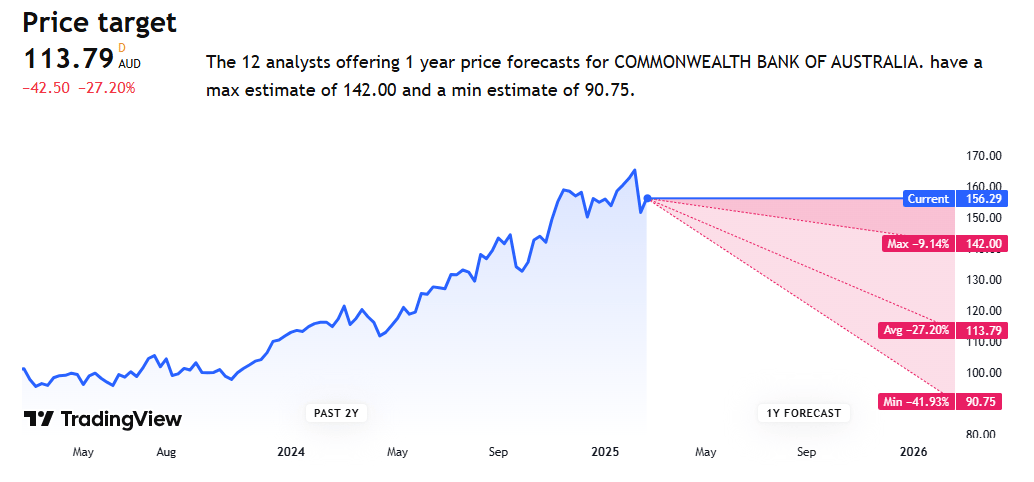

The RBA’s monthly inflation data has only been around since October 2022. The hope is that it will eventually replace the quarterly inflation data but at the moment the ABS just can’t collect and calculate fast enough. So this means that the monthly inflation data does not update all its data points every month. In particular, 38% of the data for January, April, July, and October are carried over from the previous month.

So while the RBA’s favourite inflation measure, the trimmed mean, increased from 2.7% in December to 2.8% in January, the RBA will take little notice. Headline inflation was unchanged at 2.5% (see chart below).

February only has 27% of its data carried over but still the RBA will be looking towards the March-quarter inflation result which will be released on 30 April.

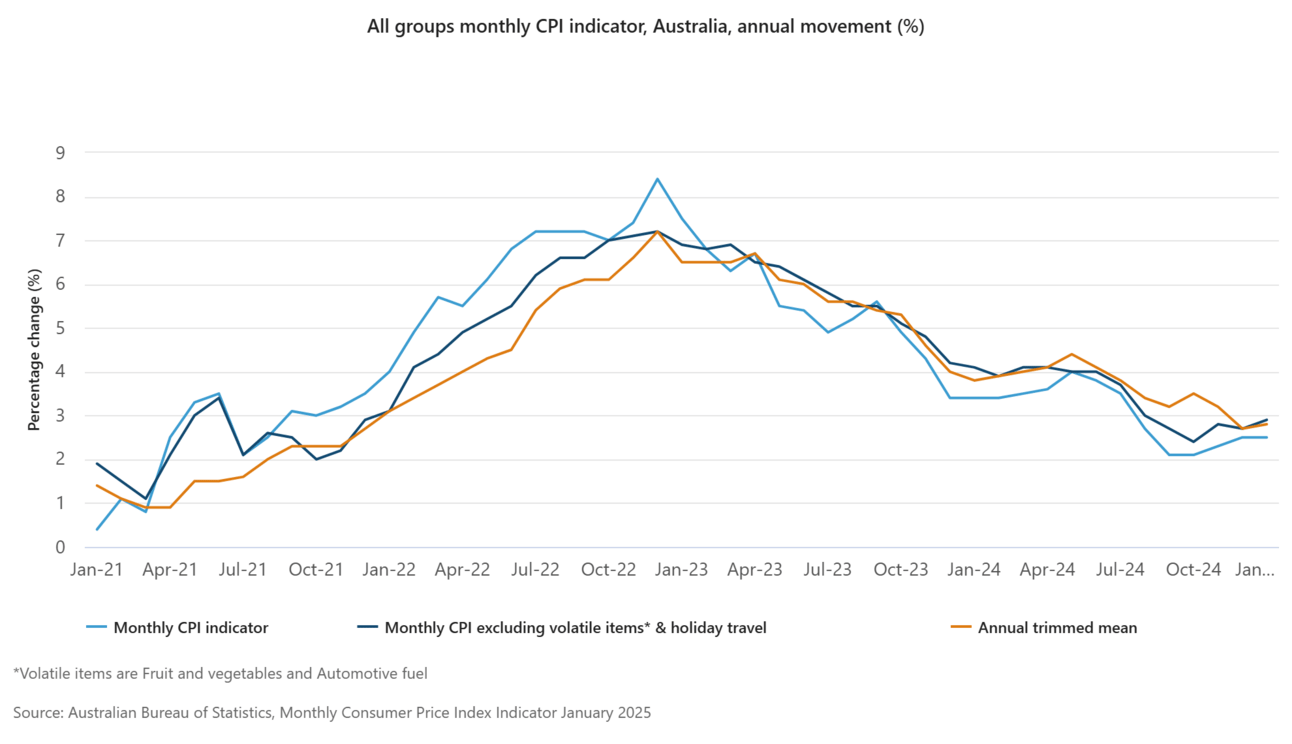

3. Chinese warships and rare earth minerals

The hoo-ha about the Chinese warships off the coast of Sydney has the Australian press in a panic not seen since they thought Russian ships were going to invade in the 1870s.

But there is no need to worry right? Uncle Sam has our back right? We didn’t “go all the way with LBJ” just for Trump to turn his back on us now!

I mean look at Ukraine they are going to fight on with US help so long as they let the US develop some of their rare earth mineral deposits. Lucky for us, we have heaps of the stuff (see chart below).

Final thoughts

CBA is overvalued but so is the “magnificent 7” tech stocks in the US. A correction may come at some point but nobody knows when. It is a bit like the next interest rate cut in Australia!

Key dates over the next 7 days

March 3: RBA Board minutes released

March 4: December quarter GDP released