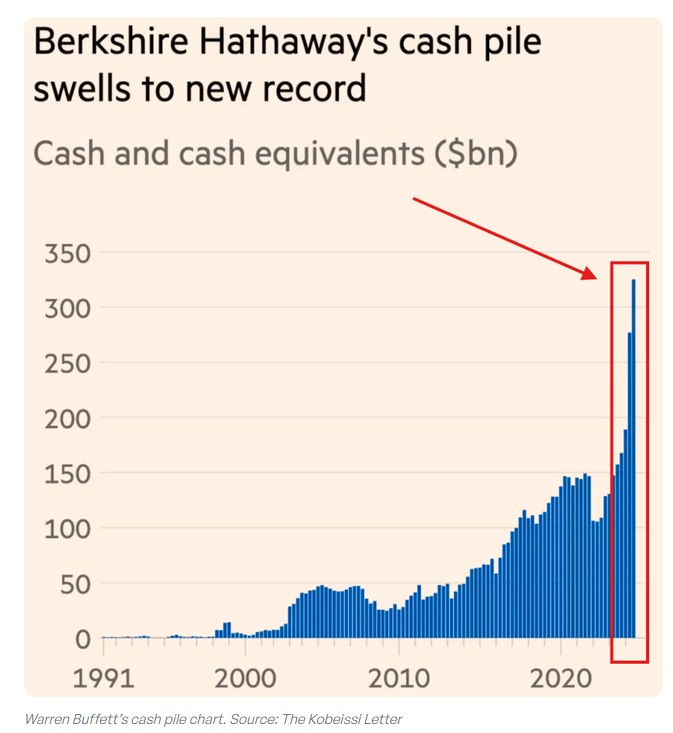

Warren Buffett likes to buy when others panic so it is alarming to see Berkshire Hathaway’s cash position swell to a record USD 334 billion. 94-year-old Buffett may have started using a walking stick but when it comes to the market he is usually leaps and bounds ahead of other fund managers.

Meanwhile S&P and Walmart point to slower economic growth in the months ahead.

Three point summary

1. Berkshire Hathaway increases cash position

Berkshire Hathaway has increased its already record cash position even higher to USD 334 billion (see chart below). On Saturday, CEO and Chairman Warren Buffett released his annual letter but did not reveal his thinking behind the big cash position. He simply said that the company remains committed to equities.

In recent years, Buffett has bemoaned the lack of good opportunities in an expensive US market. This has seen him take big investments in Japanese trading houses.

However, in building up cash, one has to think that Buffett senses that the market is about to be shaken up and that buying opportunities will be had.

Opportunities come infrequently.

When it rains gold, put out the bucket, not the thimble.”

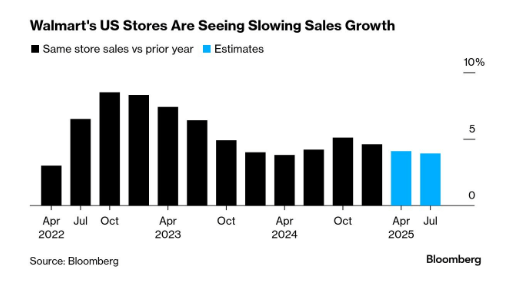

2. Walmart

The US’s largest retailer released its fourth-quarter earnings last Thursday and surprised the market with EPS of 0.66 cents versus the expected 0.64. Revenue was up 4% and e-commerce sales up 20%.

However, the market zeroed in on Walmart’s forecasts which showed slowing sales over the next two quarters (see chart below). Walmart CFO David Rainey pointed to the expected impact of tariffs and global geopolitical uncertainty.

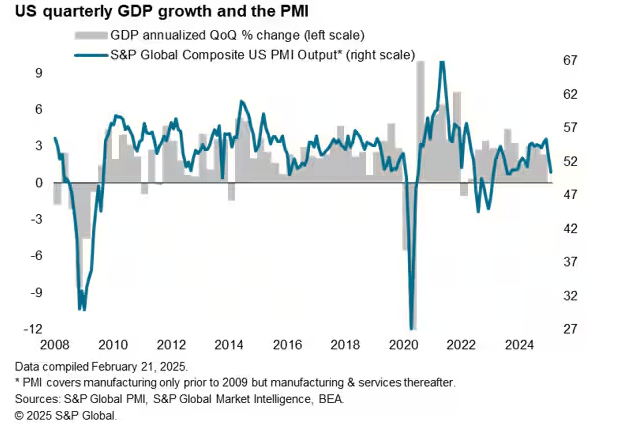

3. S&P also sees growth slowing

S&P released its flash PMI surveys last Friday which suggest that US growth has dropped to just 0.6% on an annual basis in February. As you can see in the chart below, the S&P Composite US PMI Output index provides a good leading indicator of actual US output.

S&P’s Chief Business Economist says its best:

“The upbeat mood seen among US businesses at the start of the year has evaporated, replaced with a darkening picture of heightened uncertainty, stalling business activity and rising prices.

Optimism about the year ahead has slumped from the near-three-year highs seen at the turn of the year to one of the gloomiest since the pandemic.”

Final thoughts

Between tariffs and Ukraine, I’ve never felt so uncertain about the geopolitical stage. While Trump’s rhetoric may prove more bark than bite, markets don’t like whiplash. From Buffett to Walmart, its seems caution is eroding the inauguration high.

Key dates over the next 7 days

February 26: New home sales for January

February 28: PCE price index

March 3: ISM Manufacturing PMI for February